22 Nov 2023

22 Nov 2023

In recent years banking industry has adopted many technological features like intelligent and robotics technologies. The financial sector is no stranger to the need for accuracy, compliance, efficiency. Automation has become the cornerstone transformation in the banking industry. Now, RPA (Robotic Process Automation) has become a new technological advancement that has financial institutions. RPA in Banking has not only altered the industry but also paved the way for highly efficient, cost-effective, and error-free processes. In this blog, we’ll delve into RPA is, and what are its benefits financial industry.

RPA (Robotic Process Automation) is a revolutionary technology that lets a wide range of repetitive, rule-based using the of software robots or "bots." bots are not physical machines but are lines of code that the actions a human user with computer systems and applications. RPA essentiallymanual, time-consuming tasks that human employees traditionally performed with automated processes.

These RPA bots can perform various tasks, data entry, document extraction, reconciliation, data validation, and even decision-making processes, all while adhering to predefined and workflows. RPA in Finance can work across multiple systems and applications, which makes versatile and applicable in various industries, including finance.

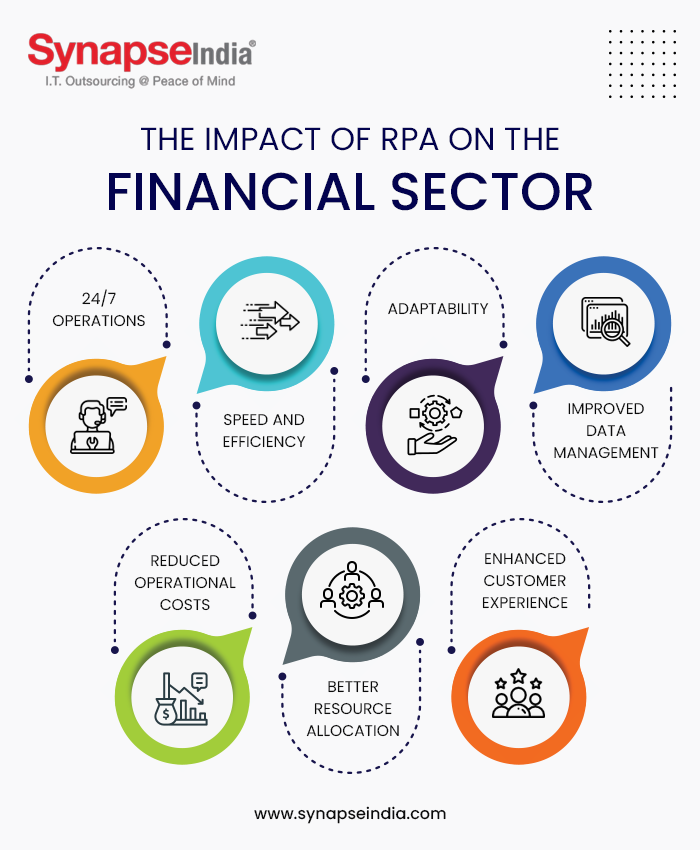

The financial sector is known its complex highly regulated processes. RPA offers numerous benefits that address the unique challenges faced by financial institutions:

Human errors can be costly and detrimental to finance. RPA in Banking ensures near-perfect accuracy in tasks, reducing the risk of mistakes in data entry, reconciliation, and compliance- processes.

RPA in Finance bots 24/7 without need for breaks or vacations, significantly processes. This efficiency translates into faster transaction processing improved customer service.

Automating repetitive tasks with financial process automation reduces need a large workforce dedicated to manual data entry processing. This results in significant cost savings financial institutions.

Compliance with ever-evolving is a top priority in finance. Banking automation ensures that processes executed and in with the established rules, reducing compliance risks.

Data security is paramount in the financial sector. RPA in Finance can be programmed to follow strict security protocols, reducing the risk of data breaches and unauthorized access.

Financial can scale their RPA solutions as needed to meet the demands of their growing customer base or changing business landscape.

Improved efficiency and accuracy faster service and fewer errors, leading to increased customer satisfaction and trust.

Adopting RPA gives institutions a competitive edge, as they can provide better and more cost- services compared to their competitors who on manual processes.

RPA has revolutionized the sector in several significant ways:

RPA has drastically accelerated various financial processes. Tasks that once took hours or days can now be completed in minutes. Financial process automation speed is crucial in areas like processing,onboarding, and claims processing, which benefit from turnaround times.

The financial sector is notorious its costs, the need for a large workforce to manage routine tasks. RPA reduces these by automating a substantial portion of these tasks, which means fewer full- employees are needed to complete the same work.

The sector competitive, and customer experience plays a vital role in retaining and clients. Finance streamlines processes reduces errors, and provides responses, resulting anoverall customer experience.

The sector with enormous amounts of daily. RPA not only automates data entry but can also extract, validate, and update data across various systems, data accuracy integrity.

operates around the clock, ensuring critical financial tasks can be executed at any time. This is particularly for global institutions that serve clients in different time zones.

By automating routine, rule-based tasks, RPA in Banking allows financial to allocate their resources to more strategic, value-added activities, such as customer relationship management, financial analysis, strategic planning.

The financial sector is dynamic, with changing regulations and market conditions. RPA is and can be updated reconfigured to accommodate these changes swiftly.

RPA has found applications across financial activities, including:

Banking automation can automate data entry, reconciliation, and reporting, ensuring the accuracy and timeliness of financial records.

RPA speed up loan origination,verification, and approval processes, reducing the required to disburse borrowers.

Automating payment processing tasks, such as invoice and accounts payable, can help institutions save time and resources.

Insurance companies benefit from RPA in claims processing by the assessment of claims and ensuring that processed and quickly.

RPA can automate the extraction of data from various sources and it into the required format for reporting, ensuring compliance with financial regulations.

Robotic Process Automation (RPA) has evolved as a game- in the banking industry. Since its onset, it has offered improved efficiency, cost savings, compliance, and maximum customer experience. RPA in Banking automates tasks and has made the industry more competitive and adaptable. In an ever-changing landscape, banking industry continues to embrace this technology. As the are moving towards technology are poising to reap many benefits of automation, solidifying their position in a digital and data-driven world.

21 Apr 2025

21 Apr 2025